Introduction: Why Gomyfinance .com Matters in Today’s Financial Landscape

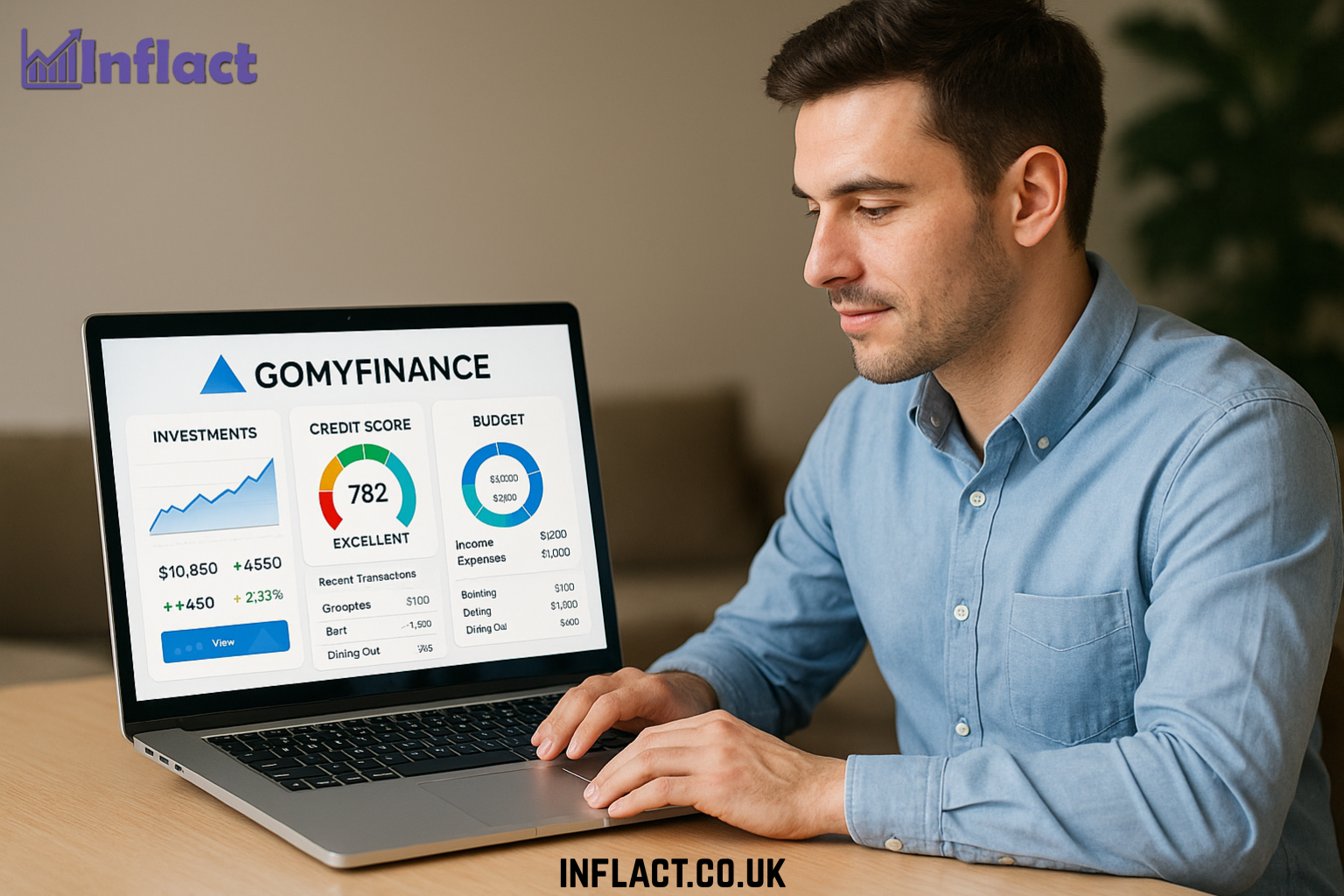

In a world where managing money is increasingly complex, digital tools have become essential for personal financial planning. From budgeting to investing and tracking credit scores, individuals are searching for platforms that can simplify these tasks in one convenient place. Gomyfinance .com is one such solution, offering a full suite of financial management tools designed to help users gain better control over their money.

Whether you’re trying to save for a big purchase, reduce debt, or begin investing, Gomyfinance .com provides an intuitive and secure way to monitor your income, expenses, bills, credit profile, and long-term financial goals—all under one platform.

What Is Gomyfinance .com?

Gomyfinance .com is an all-in-one personal finance platform that allows users to track budgets, manage bills, monitor credit, and invest, using a user-friendly online dashboard. The site caters to a broad range of users—from those new to financial literacy to experienced individuals looking to optimize their money habits.

Core Features:

- Real-time budget creation and tracking

- Bill management with automated reminders

- Credit score monitoring and alerts

- Beginner-friendly investment tools and portfolio management

- Secure syncing of bank and card accounts

Related terms: digital budgeting tool, financial planning app, credit tracking software, all-in-one finance platform.

Also Read: Kennedy Funding Ripoff Report: A Complete Guide to Allegations, Facts, and Precautions

Budgeting and Expense Monitoring Made Simple

At the heart of Gomyfinance .com is its easy-to-use budgeting feature. Users can create custom budgets, categorize their expenses, and track spending habits in real-time.

Key Functions:

- Visual dashboards that break down where your money goes

- Custom spending categories (groceries, transportation, rent, etc.)

- Alerts when you exceed set spending limits

- Historical data to spot spending trends

This system is ideal for users who need to become more intentional with their money. By logging all income and expenses, you can make informed decisions about your financial future.

Bill Management and Payment Reminders

Forgetting to pay bills on time can result in penalties, credit score damage, and financial stress. Gomyfinance .com includes a powerful bill tracker that helps users stay on top of upcoming payments.

Features:

- Add recurring bills such as rent, subscriptions, and utilities

- Calendar view for scheduled payments

- Notifications before due dates

- Expense forecasting based on past payments

This feature ensures you’re never caught off guard by a surprise charge or late fee, making it easier to maintain a strong financial record.

Related terms: bill tracker, payment schedule, financial alerts, monthly expense planning.

Investing with Gomyfinance .com

In addition to budgeting and bill tracking, Gomyfinance .com offers built-in investing tools that are perfect for beginners. You can start with small contributions, set your risk tolerance, and allow the platform’s automated tools to manage your portfolio.

Investment Features:

- User-friendly interface for setting financial goals

- Robo-advisor technology for automatic portfolio management

- Access to diversified assets (stocks, ETFs, and more)

- Real-time updates and performance tracking

This lowers the barrier to entry for people who have been hesitant to invest due to lack of experience or confidence.

Step-by-Step Guide: How to Use Gomyfinance .com

Here’s how to get started and make the most of your Gomyfinance .com account.

Step 1: Create a Free Account

Go to Gomyfinance .com and sign up with a valid email address. Choose a secure password.

Step 2: Link Your Financial Accounts

Safely connect your bank accounts, credit cards, and loan providers to enable automatic data syncing.

Step 3: Set Up Your Monthly Budget

Input your monthly income and divide expenses into categories. Assign limits to each category to stay accountable.

Step 4: Add Recurring Bills

List regular bills with due dates. Enable alerts to receive reminders and avoid late fees.

Step 5: Enable Credit Monitoring

Track your credit score and receive alerts when there are changes or issues that require your attention.

Step 6: Begin Investing

Set your investment goals (e.g., retirement, savings) and risk level. Fund your investment account and let the robo-advisor do the rest.

Tips:

- Log in weekly to monitor your spending.

- Revisit your investment strategy every quarter.

- Use mobile notifications to stay informed on bills and spending.

Security, User Experience, and Support

Gomyfinance .com places a high priority on user security. All financial data is encrypted using bank-grade technology. Two-factor authentication and secure login protocols help protect against unauthorized access.

User-Friendly Design:

- Clean, responsive interface

- Accessible on desktop and mobile

- Minimal setup time

- Step-by-step onboarding for first-time users

Also Read: Fintechzoom.com DAX40: A Comprehensive Guide to the DAX 40 Index and Its Impact

Conclusion: Why Gomyfinance .com Is Worth Exploring

If you’re searching for a comprehensive, easy-to-use financial management solution, Gomyfinance .com is a smart choice. It combines budgeting, bill tracking, credit monitoring, and investing into one seamless experience. By automating many aspects of personal finance, it reduces mental load while increasing financial awareness and long-term stability.

Whether you’re new to money management or looking for a better system, Gomyfinance .com offers the tools and flexibility you need to build better financial habits, grow your wealth, and stay in control of your money.

Frequently Asked Questions (FAQs)

1. Is Gomyfinance .com free to use?

Yes, many of its core features like budgeting and bill tracking are free. Premium features such as advanced investment tools or credit monitoring may require a subscription.

2. Can I invest directly through Gomyfinance .com?

Yes. The platform allows you to invest in stocks, ETFs, and other assets using automated investment options.

3. Is Gomyfinance .com safe to use?

Yes. The platform uses bank-level encryption and secure authentication to protect user data.

4. Do I need to link my bank accounts to use the platform?

While it’s optional, linking your accounts enables automatic transaction syncing, making budgeting and bill tracking much easier.

5. Can I use Gomyfinance .com on mobile devices?

Yes. The platform is mobile-responsive and can be accessed via web browser on phones or tablets.